The Real Reason Chicken Strips Are Taking Over Fast Food (It Has to Do With the Economy)

There’s a strange sense of deja vu that can hit you when you’re staring up at a fast-food menu. You notice something, an echo from one drive-thru to the next, and start to wonder if you’re imagining it. This year, that feeling is almost certainly being caused by chicken strips. It started quietly, but now it feels like every major chain has decided that long, breaded pieces of chicken are the answer to some question you didn’t even know was being asked. It’s more than just another menu item in the endlessly churning cycle of food trends.

This sudden obsession isn’t really about a collective, spontaneous craving for tenders. It’s a quiet signal, a sort of economic weather report being delivered through fried chicken. What you’re seeing pop up on the menus at McDonald’s, Taco Bell, and Wendy’s is a direct response to a slowdown that’s being felt in the wallets of millions of ordinary people. The story of why chicken strips are suddenly everywhere is really the story of what happens when a huge part of the country starts to feel the squeeze.

A Sudden Bet On Breaded Chicken Strips

The rollout has been methodical. Back in April, McDonald’s made waves by adding McCrispy Strips, its first new permanent item in the U.S. in four years. For many, it was seen as a clear precursor to the return of the beloved Snack Wrap, but it was also a standalone bet on a proven classic. Only two months later, Taco Bell, a chain not typically known for its fried chicken, jumped in with its own take, loading new tacos and burritos with crispy strips as a central part of its summer menu.

Just this week, Wendy’s decided it couldn’t miss the party any longer, announcing its new “Tendys” complete with a lineup of six different dipping sauces. The timing isn’t a coincidence. Wendy’s has been hoping to claw back some of the ground it’s lost recently. In its second quarter, the company’s global same-restaurant sales fell by 2.9 percent, with the situation in the U.S. looking particularly tough after a 3.2 percent slump in the first half of the year.

Meanwhile, Taco Bell has been a rare beacon of consistent growth, and McDonald’s got a solid bump in its own second quarter. The company’s CFO even highlighted the new McCrispy Strips as a key reason for that success. It seems less like a trend and more like a strategy, a panic button shaped like a chicken tender.

Chicken Strips Tell A Bigger Story

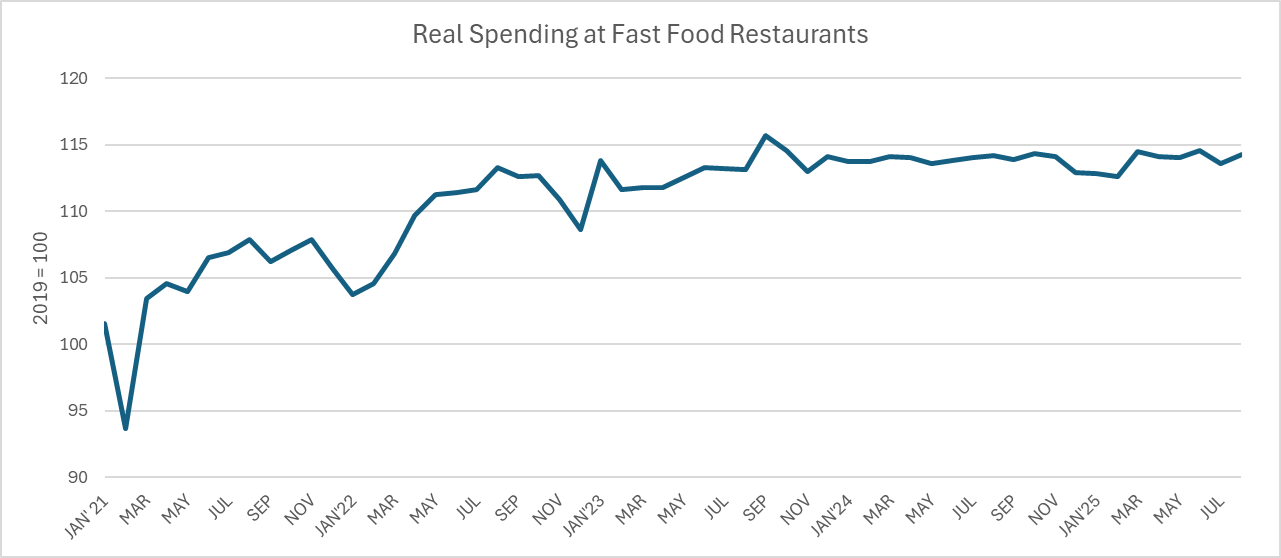

To understand why these chains are all making the same move at the same time, you have to look past the menu boards. According to Dean Baker at the Center for Economic and Policy Research, fast food is the right place to start if you want a real sense of what’s going on with the finances of average workers, not the high-income earners with stock portfolios to cushion them. And what the spending data shows is a clear and concerning pattern. After a few years of strong recovery, fast food spending hit a wall. Baker notes that spending really slowed down in 2024 and has essentially stagnated this year.

In response, chains are trying whatever they can to get more people in the door. You might see more discounts or cheaper items added to the menu, but you’re unlikely to see actual prices go down. As Michael Halen at Bloomberg Intelligence points out, margins are just too tight between inflation and rising labor costs. Deals and discounts do help, bringing in about a quarter of a restaurant’s traffic according to surveys. But what’s really been driving people to come back has been what Sara Senatore at Bank of America calls “innovation and brand activation.” Think less about dollar menus and more about things like Minecraft Happy Meals or Chipotle’s adobo ranch dip. These new chicken strips fit perfectly into that playbook. They’re new, they’re familiar, and they’re just innovative enough to get people’s attention.

The Stagnation Behind The Chicken Strips Craze

The reason for all this strategic maneuvering becomes clearer when you look at the hard numbers. For years, economists have used real, inflation-adjusted spending at fast food restaurants as a useful gauge of consumer health. It’s a smart approach because it focuses on the segment of the population whose spending habits are most sensitive to changes in their income. While wealthy people might grab a fast-food meal, their visits don’t really increase just because the stock market is up. Changes in fast-food consumption are therefore a powerful reflection of what’s happening with lower and middle-income families.

Credit: Counterpunch

The data shows a dramatic shift. Throughout 2021, 2022, and 2023, real spending in this sector was growing at an average annual rate of 5.4 percent, much faster than the pre-pandemic decade. But that growth came to a halt. Real spending in December 2024 was actually a full percent lower than it had been the year before. That stagnation has continued right through 2025, with spending in August barely moving from where it was at the end of last year. This isn’t just a feeling; it’s a documented slowdown that suggests most workers do not feel like they are getting ahead right now.

A Sign Of Two Different Economies

This pattern of stagnating spending aligns almost perfectly with the data on real wages. For non-supervisory workers in the hotel and restaurant industry, real hourly wages are less than a percentage point above where they were in December of 2023. While it’s good that wages aren’t falling, a gain of less than one percent in almost two years isn’t much to celebrate. This economic pressure is what’s forcing the hand of fast-food giants, pushing them toward safe, familiar, and easily marketable products like chicken strips.

What’s particularly interesting, and what points to a larger economic divide, is that full-service, sit-down restaurants have been holding up much better. This runs counter to what you’d typically expect in a period of economic stress. Sara Senatore attributes this, in part, to those higher-income customers who are still spending freely. It’s a clear sign of a K-shaped economy, where the experiences of the wealthy are diverging sharply from those of everyone else. So the next time you see another ad for a new chicken strip, you’re not just seeing a lunch special. You’re seeing the result of a complex economic story, where a simple piece of fried chicken has become the go-to answer for a nervous industry facing an even more nervous customer base.