Throwing away money on everyday habits can be a quick way to go broke. These habits often result in significant, unnecessary expenses. Frequent takeout dinners and impulsive online shopping are some common behaviors that will drain your wallet without you even realizing it.

Unused Health Club Memberships

- Credit: iStockphoto

Many are tossing $120 a month on unused club memberships. It's like paying for a service you don't use. Avoid wasting your hard-earned cash by canceling that membership and opting for home or outdoor activities. This will keep your wallet happy and your body active without the extra expense.

Frequent Takeout Dinners

- Credit: freepik

Opting for takeout dinners often drains your wallet quickly. The convenience is paid for. Choosing to cook at home will save you money and guarantee a healthier diet. Swap takeout for homemade meals, and you'll see significant savings over time. Keep your budget and health in check without sacrificing taste.

Daily Convenience Store Purchases

- Credit: freepik

Daily convenience store runs stack up faster than a rat up a drainpipe. Skipping them or shopping in bulk are smart strategies. Stock up on essentials during grocery trips to avoid impulsive buys that dent your budget. This simple redirection will result in substantial savings.

Unused Retail Memberships

- Credit: Facebook

There's a hidden money drain in your unused retail memberships. You don't need that many memberships; cancel those you don't use. Instead, shop smart with online deals and discounts, saving money without incurring membership fees. This way, you retain more money in your pocket without compromising quality.

Coffee Shop Visits

- Credit: freepik

An evening coffee shop visit isn't harmful until you get addicted to it. It'll burn through cash quickly. Your homemade coffee will give you the same taste and quality. Just invest in a quality coffee maker and enjoy your favorite brews without the daily expense.

Paying for Cable TV

- Credit: pexels

Today, paying for cable TV can be a big waste, and this is swallowing up your funds. Instead, switch to streaming services or free channels, which will save you money. Enjoy entertainment without the hefty cable bill. It's a move that provides access to plenty of content without overspending.

Late Fees and Penalties

- Credit: iStockphoto

Your procrastination also eats away at your funds. Don't wait until it's too late to pay up. Late fees and penalties will drain your finances. Set up automatic payments and reminders to keep track of due dates. This avoids unnecessary charges. Stay on top of bills and save.

Brand Name Shopping

- Credit: pexels

Brand-name shopping often comes with a hefty price tag. Choosing generic or store brands that offer the same quality at a lower cost is what you need before you can get there financially. This is a simple switch that will lead to substantial savings. Enjoy the same products without straining.

Failing to Attend Your Gym Sessions

- Credit: Facebook

Paying for a gym you never attend is wasteful. Consider at-home workouts or free outdoor exercises to stay fit without the monthly fees. You'll save money while maintaining your health and fitness. With limited time on your hands, you can still stay active without incurring unnecessary expenses.

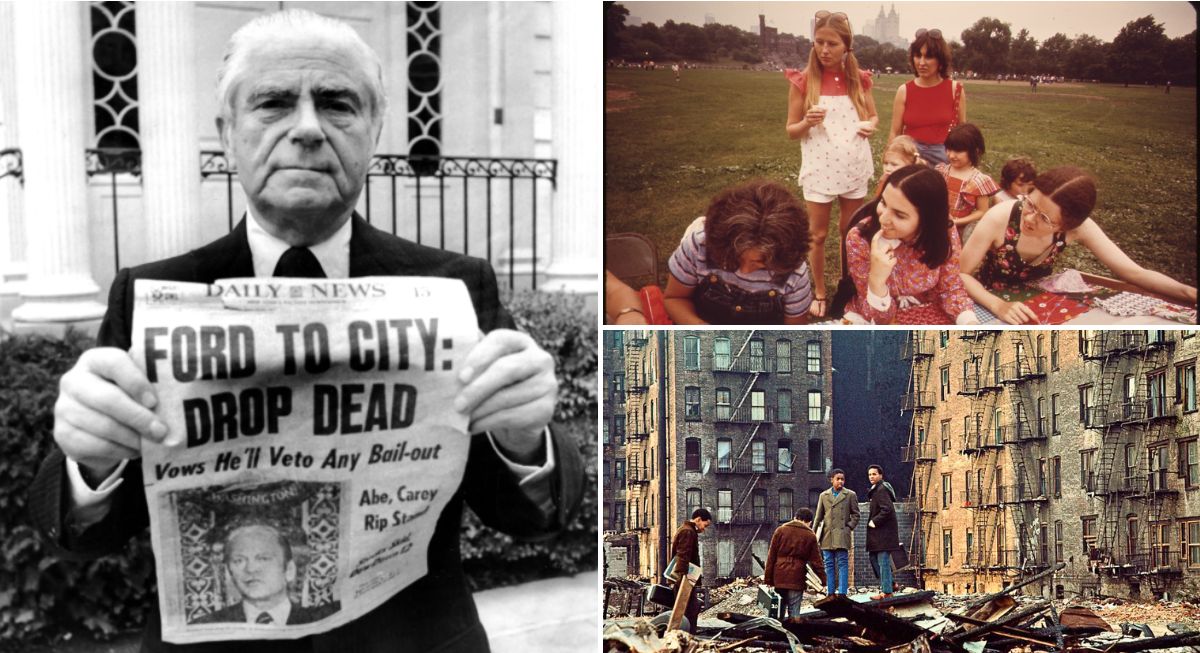

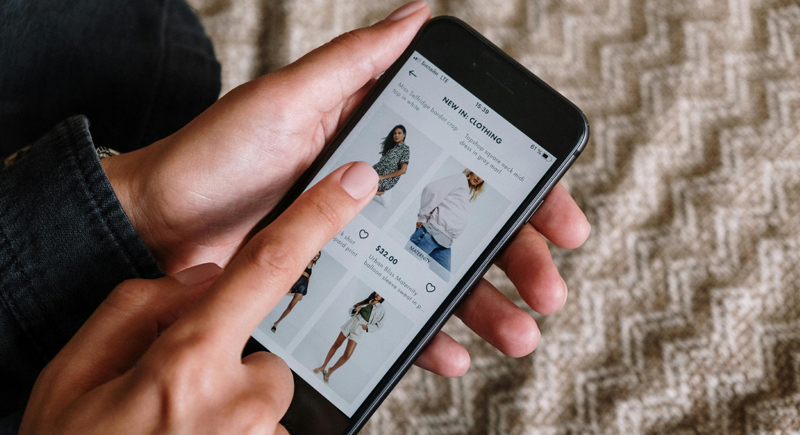

Impulsive Online Shopping

- Credit: pexels

Are you the type that sees an interesting item online and instantly orders it? This impulsive online shopping quickly empties your wallet. Curb the habit by setting a budget and sticking to it. Your finances will be kept in check, and unnecessary spending will be reduced.

Regular Taxis or Ride-Shares

- Credit: pexels

Regular use of taxis or ride-shares can be costly in the long run. To secure your hard-earned savings, consider using public transport, biking, or walking. Apart from being healthy, these alternatives are wallet-friendly. Save on transportation costs while staying active.

Frequent ATM Withdrawals

- Credit: pexels

Frequent ATM withdrawals rack up fees because every visit to the machine is charged. Planning ahead and withdrawing large amounts minimizes your trips and saves you money. This helps you manage your cash better. Eliminate the fees and keep your wallet intact at all times.

Regular Alcohol Consumption at Bars

- Credit: freepik

Regularly drinking at bars is expensive, despite its perceived social benefits. Your best option is a home gathering where you can enjoy drinks at a fraction of the cost. It's socially satisfying and budget-friendly. Enjoy your favorite drinks with your favorite people without the hefty bar tab.

Frequent Movie Theater Visits

- Credit: freepik

These trips can add up and surprise you at the end of the month. You have more budget-friendly options, like streaming movies at home or attending discount showings. This way, you can enjoy entertainment without incurring high costs. You'll stay entertained without breaking the bank.

Frequent Car Washes

- Credit: freepik

Frequent car washes can be a money sink. Most of the time, your car never needs a sophisticated wash. Opting to clean your car at home or use less expensive self-service options saves you a lot. It keeps your car clean without draining your wallet.