Debt inherited from parents is a subject that frequently stays hidden in financial conversations. Although it's a scenario no one wants to deal with, it's becoming more and more typical in today's debt-ridden society. Inheriting debt might feel like a curse, even if inheriting riches can be a blessing. This blog will explore how to deal with inherited debt from parents and protect yourself.

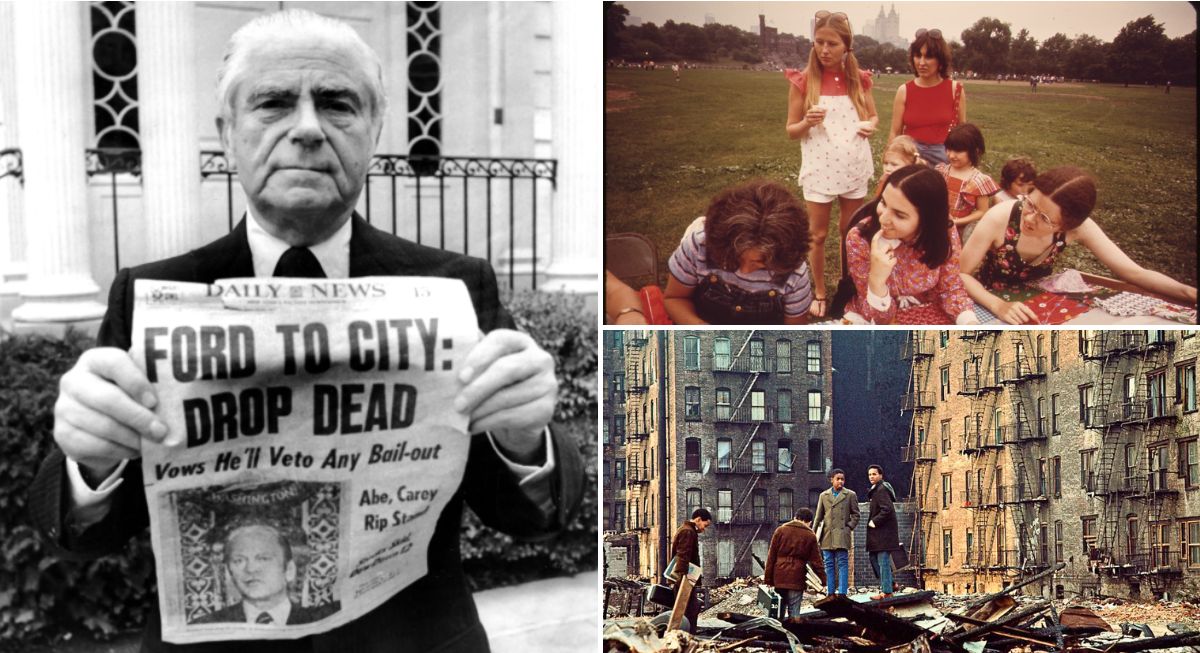

Recognizing the Laws

Credit: pexels

Comprehending the legal ramifications of debt inheritance is crucial. Generally, you are not held personally responsible for your parents' debts. Usually, the estate of the deceased is used to pay off debts. Usually, the debt dies with the estate if it is not paid off. There are, however, some exclusions, such as if you cosigned a loan or are facing particular problems, such as federal student loans or unpaid taxes.

Policies for Insurance

Credit: pexels

In these circumstances, life insurance coverage saves lives. Verify whether your parent has insurance that pays off outstanding obligations. By doing this, financial strain can be reduced, and asset liquidation can be avoided.

Specialized Solutions

Credit: pexels

Since each circumstance is different, there may be moments when unusual answers are needed. If you inherit a home with a mortgage, consider renting it out to help pay the mortgage. Alternatively, look into opportunities for asset-backed loans if you inherit valuable but non-liquid assets.

Defending Yourself

Credit: pexels

You need to safeguard your valuables and yourself. Pay off debts gradually until you have a complete knowledge of the situation. Unless it is necessary by law, avoid using your cash to pay off your parent's obligations. Keep your money apart, and be cautious of collectors who may try to get you to pay money you don't owe.

Emotional Aspects to Take into Account

Credit: pexels

Managing debt following a parent's death is a very emotional experience. Taking care of your mental and emotional well-being is critical during this time. Never be afraid to ask friends, family, or licensed counselors for help. Remember that controlling the situation's emotional weight is just as important as managing the money.

Handling the Estate

Credit: pexels

When a parent passes away, their estate goes through a procedure known as probate. This is the location for asset distribution and debt settlement. It's assembling information on the worth of the estate and existing debts. Locate a probate lawyer; they will be accommodating in helping you through this challenging procedure. They can assist in determining whether debts are dischargeable or negotiable and which must be paid in full.

Acquiring Knowledge and Proceeding

Credit: pexels

Make the most of this event by learning from it. Learn about debt management, estate planning, and money management. This information benefits you and prepares you for a more stable financial future.

Debt Settlement and Negotiations

Credit: pexels

Negotiating or settling certain debts for less than the whole amount owed is possible. This is especially valid for loans that are not secured, such as credit card debt. Debt settlement firms can negotiate on your behalf; nevertheless, use caution and investigate their reliability. A straightforward phone call outlining the circumstances might occasionally result in a satisfactory outcome.

Estate Planning Consultation

Credit: pexels

After addressing immediate inherited debt concerns, seeking guidance from an estate planning professional is essential. They can offer asset protection and inheritance planning strategies, ensuring your future wishes are clearly outlined and legally protected. This step is crucial for preventing similar financial burdens on your heirs, providing you and your family peace of mind and a secure financial future.

Credit Protection Strategies

Credit: pexels

Inheriting debt may impact your credit indirectly, especially if you're managing estate affairs. Protect your credit by monitoring your credit report regularly to ensure no incorrect liabilities are attributed to you. Additionally, be proactive in separating your financial dealings from the estate’s obligations. If necessary, consult with a financial advisor or credit counseling service to understand how to shield your credit from the potential negative impacts of inherited debt.

Utilize Government and Non-Profit Resources

Credit: pexels

Numerous government and non-profit organizations offer free advice and services to individuals with inherited debt. These resources can provide valuable information on debt management, legal rights, and possible assistance programs. Utilizing these resources can offer additional support and guidance, helping you make informed decisions without the burden of high consultation fees.

Emotional and Financial Balance

Credit: pexels

Maintaining a balance between emotional well-being and financial responsibilities is crucial. Inheriting debt can be overwhelming, so it’s important to prioritize self-care and seek emotional support when needed. At the same time, focus on creating a solid financial plan to address the inherited debt systematically. Balancing these aspects can help you manage the stress associated with debt inheritance and move forward more confidently.